A free calculator can help you understand your options.

By Robin, on behalf of the Disability Advice Team

I’ll admit it—Social Security Disability Insurance (SSDI) used to sound like something far away, something that only applied to “other people.”

But after my health took a turn and I had to stop working, I realized I needed to understand what help might actually be available.

That’s when I came across Disability Advice’s SSDI Calculator and Guide. It’s not just a number-cruncher—it’s a quick, clear starting point for anyone trying to figure out whether they might qualify for SSDI benefits.

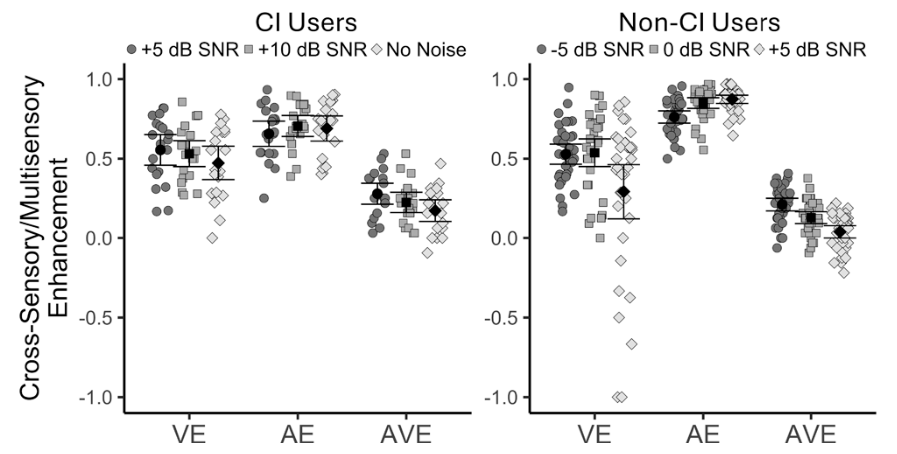

To determine your SSDI, among other factors your earnings history feeds into your “Average Indexed Monthly Earnings,” and this gets translated into a benefit through a three-tiered formula. Credit: @sharonmccutcheon/Unsplash

Now that I know about this disability advocacy group that advocates for people with claims pending before the Social Security Administration, I’m here to help you navigate this often complex process.

Why I Tried It

I’d read about how challenging the SSDI process can be. There are so many variables: your work history, income, disability type, age, and more. But with help from the guide, it finally made sense to me.

It explains everything from how benefits are calculated to what factors might reduce your payment, like receiving other public benefits, or whether your family could also qualify based on your record. It’s written in plain language, which I appreciated.

How the Calculator Works

Using it was simple:

I entered the last year I worked.

Then, I put in my average annual income over the past 10 years.

And just like that, I got an estimated monthly SSDI benefit. It’s not an exact figure, but it gave me a sense of what I might receive if I’m approved.

What I liked most was that the tool didn’t just spit out a number—it explained why that number showed up.

It talked about how your earnings history feeds into your “Average Indexed Monthly Earnings,” and how that gets translated into a benefit through a three-tiered formula. Honestly, I’d never understood that until now.

What I Learned From the Guide

The guide also pointed out that SSDI isn’t just about having a disability—it’s about meeting medical and work criteria. For example, you need to have earned enough work credits, and your condition must prevent you from doing substantial work for at least a year.

I also learned that:

If you’ve received workers’ comp or state disability, your SSDI may be reduced.

Family members (your spouse or kids) may be eligible for benefits, too.

And yes, some SSDI payments are taxable, depending on your income.

What I’m Doing Next

Thanks to this calculator and guide, I finally feel like I’m starting from a place of knowledge instead of confusion. I now have:

A benefit estimate I can plan around

A checklist of what I need to prepare (medical records, past earnings, etc.)

A better understanding of what to expect from the application process

I also know that getting approved isn’t always easy—so I might look into speaking with a disability advocate to help guide me through the paperwork.

Final Thoughts

If you’re like me and have been wondering where to start with SSDI, I highly recommend checking out DisabilityAdvice.org and using Disability Advice’s SSDI Calculator and reading their guide. It gave me answers when I really needed clarity—and helped me feel less overwhelmed in a time when everything felt uncertain.

It’s a small step, but it made a big difference.

Disabilityadvice.org is a disability advocacy group that advocates for people with SSDI or SSI (Supplemental Security Insurance) claims pending before the Social Security Administration. Their website says, “We provide advocacy services for Americans who are disabled and unable to work. We help claimants with applications for Social Security Disability benefits. While we have many advocates on our staff, we are not a law firm and do not provide legal service or represent claimants in an attorney-client relationship in this process.” It adds, “Disability Advice is neither affiliated with nor endorsed by the Social Security Administration, United States Department of Veterans Affairs, or any other government entity or agency.”

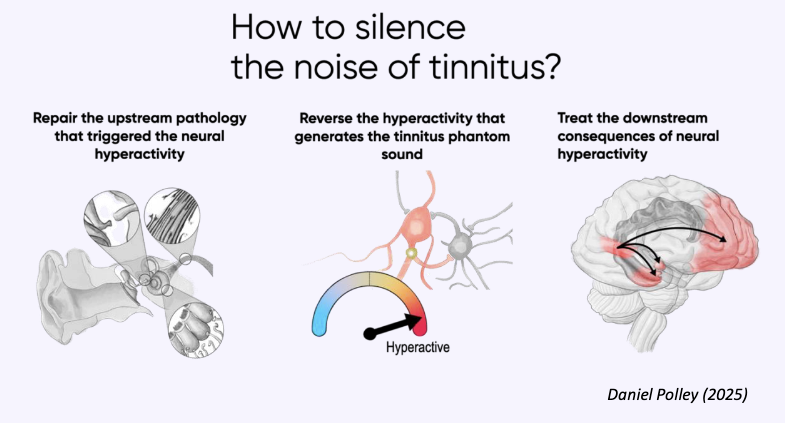

Because noise-canceling earbuds are so comfortable and block everything out, people wear them for three, four, five hours straight without realizing the cumulative effect on their ears.